Quantify your value: use this checklist

Image by StockSnap_Pixabay

“Checklists can make priorities clearer and

prompt people to function better as a team.”

What value does your product or service create for your customers? By value, we mean financial value. So, what financial value does your product create for your customers? Sometimes, when we ask our clients what financial value they create for their customers, clients get frustrated.

Some clients get frustrated because they: think they don’t have time to evaluate financial value; or think they don’t have the technical skill to evaluate financial value. A simple checklist saves time needed and reduces the technical skill needed. Using this checklist makes it easy for our clients to evaluate how much financial value a product or service creates for their customer.

A Financial Checklist

This checklist comes from taking a strategic view of finance. For example, as a board member, you are responsible for investing cash into assets (like buildings, machines and software) and getting a financial return on these assets. Accountants will tell you — you can measure this financial return as Return On Assets. Businessmen will tell you —you can only increase Return On Assets in a few ways.

One purpose of all organisations is to produce an appropriate Return On Investment. For-Profit organisations want to produce a good Return On Investment; Not-For-Profit organisations want to produce a reasonable Return On Investment to use their hard-won assets efficiently and effectively in delivering outcomes.

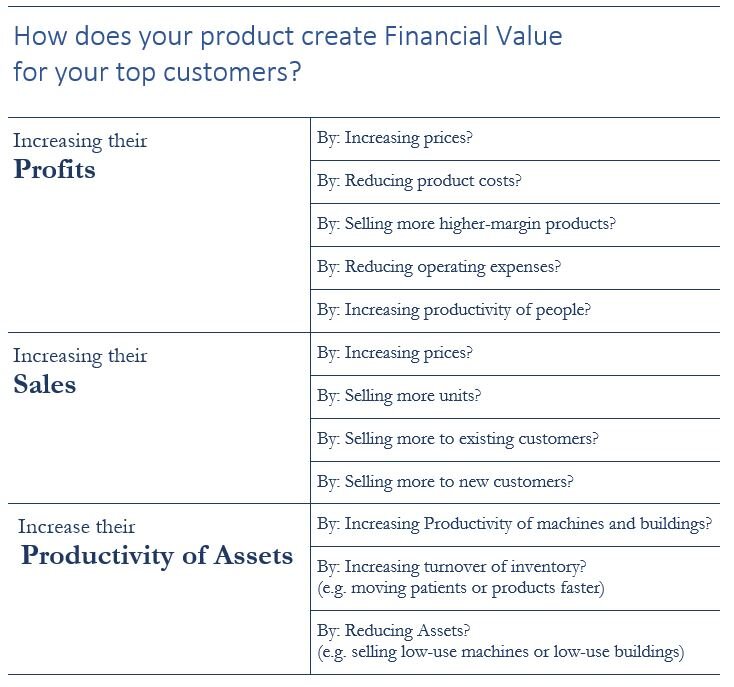

Whether your customer is For-Profit or Not-For-Profit, you have 12 possible ways to improve their financial performance, in three groups:

Practical Tips

Arrange a meeting and invite a diverse group. Attendees should be either customer experts or subject matter experts. Ensure some attendees have visited customer sites. Your aim is the broadest possible collection of views about your top customers and how you might create more financial value for your top customers.

For example, in an engineering organisation, you might invite salespeople, engineers, inventory controllers, buyers, service engineers, human resource experts and accountants.

In a pharmacy company, you might invite salespeople, pharmacists, inventory controllers, buyers, health economists, medical specialists, human resource experts and accountants.

In your meetings, at stage 1, ask how you currently create financial value for your top customers? Work through each checklist item, answer yes or no and estimate the size of financial value for each line. Don’t be surprised if you don’t know the answers. Calculating financial value is a tough exercise for most organisations because they never consider the 12 questions.

Sometimes, individuals say this saves our top customer money or improves their productivity, but no one can quantify the financial value created. Insist the meeting estimates the financial value to the best of their ability. Doing this helps the meeting see which are the most important sources of financial value for your top customers and so understand what should be your organisation's priorities. Afterwards, attendees can consider how can they preserve or even grow sources of value.

Do your top customers earn more money working with you than working with your competitors?

Some examples of how companies created financial value:

Shorter installation times by eight weeks saving installation costs and producing revenue eight weeks earlier

Increasing productivity by six patients a day increasing revenue

Changing the order of items on delivery documents to improve productivity, saving two hours/week/store

Changing packaging to be shelf-ready to save costs and to improve staff productivity

Using market information to identify fast-growing and slow-growing segments to help create faster revenue growth and higher inventory turnover.

After your meeting remember you are using the checklist to discover if your top customers make more money dealing with you. So, when you find some financial value that your competitors can create too, then that’s not too exciting. You are searching for checklist items where you can create far more financial value than your competitors.